Monday, December 29, 2008

getting back to it

I know it's been forever since I've blogged. Often I find myself completely overwhelmed by the amount of information I'm expected to process daily: I subscribe to 96 blogs in addition to following my Twitter friends and my Facebook friends (my MySpace friends have long been neglected), the news (in print and digital), any books I'm reading, my personal studies (currently my goal is to be roughly fluent in Spanish by 1/12), e-mail, and "reality" (my friends and family in "real life"). I have to journal not for the sentimental value but so I have some record of what's important to me. I spend a terribly inefficient amount of time trying to become more efficient. The "Information Age" can be quite exhausting. Sometimes I just need to sit back and listen. Listen to my imperfections, listen to the wisdom of those around me, and take time to process instead of just paying attention. With so many words and concepts being tossed at me and circulating in the blogosphere - which often overlap to a sickening degree - I don't need to be contributing to the mess. On the other hand, The Thirteenth Floor is a nice way to sit down and order my thoughts in the audience of "my people" as well as a handful of strangers. Maybe if I contribute enough original thoughts something will stick and help someone else out one day. I probably won't ever be a regular poster - I just don't have enough time (or desire) to write that much. Thanfully I can give the Reader's Digest version in 140 characters or left -- if only more of my bff's were involved, it would be much more fun. Ditto if Facebook and Twitter got together on some syncing biz.

Anywho, let's get back to it.

Tuesday, November 25, 2008

Monday, November 24, 2008

Sunday, November 23, 2008

jennifer aniston

Jennifer Aniston was featured in today's NYT Magazine. I like her and I feel that she's a really stand up kind of gal with an amazing talent for acting. She's also gorgeous and has been a model of beauty for me and my girls for some time. The quote that stood out to me was:

Whoah. It's 2008. The fact that people - especially those with so much success and bank - are so far removed from technology and all that blows my mind - especially as I move ever closer to making it my profession. As I've just spent probably 2 hours going through my Google Reader (and I complain that I have no free time...) I wonder what its like to be so free from technology. Sometimes I am doing so much on my phone with checking email, FB, NYT, CNN, Twitter and repeat, that I have to throw it down (on the car seat so that I can focus on driving...so not safe). The information age has me operating on overload 24/7.Q: Another screen that has gained in prominence since “Friends” is the computer screen. Has Internet stardom become oppressive to you?

A: Here’s where I luck out: I’m really computer illiterate. When I see people on their BlackBerrys, working them like some girls work a hair dryer, I’m just stunned. People have sent me clips from FunnyOrDie.com or YouTube, but I never seek it out. I did love that little girl in the Will Ferrell landlord clip on FunnyOrDie, but I’m content with just checking my e-mail.

Q : What about something like Facebook?

A: It’s not for me. I’d be opening myself up too much. I don’t want to sound like a complete innocent — I’ve looked at things, of course. But it’s such spewing. If I look at it, I’ll be affected. It’s like dancing with the devil. But I have spent hours on 1stDibs.com, looking at furniture. And I like to play Scrabble. And poker. I discovered Wii this weekend. I’m a late bloomer.

While we're on NYT, this quote from a Thomas Friedman article the other day has haunted me for the past couple of days:

So, I have a confession and a suggestion. The confession: I go into restaurants these days, look around at the tables often still crowded with young people, and I have this urge to go from table to table and say: “You don’t know me, but I have to tell you that you shouldn’t be here. You should be saving your money. You should be home eating tuna fish. This financial crisis is so far from over. We are just at the end of the beginning. Please, wrap up that steak in a doggy bag and go home.”It's made me rethink dropping $500+ on a plane ticket to D.C. for the inauguration in January and a couple of other big ticket items. I would like to think I'm doing relatively great as far as job prospects go but with today's economy you never know when the carpet is going to be pulled out from under your feet and that resiliency factor is more important than ever. We worry about keeping up with our friends who have the big screens, expensive purses, extravagant travels, luxe meals, etc - but how much should we be focusing on paying off our student loans ASAP, building up our savings in case the economy is shot and we lose our jobs and can't recover for 3 mo, 6 mo, 12 mo? I appreciate the nudge we need to keep reality in the forefront. I think sometimes its really easy for us to lose sight of our priorities and then get to a point where we're operating with little or no safety net. Which could prove to be detrimental in the future.

Shawn Jackson - "Feelin' Jack"

As seen in this great post from TSS.

Anybody wanna start a team with me to solve the Netflix Challenge? You win $1 MILLION if you can improve their recommendation system by 10% - which gets increasingly harder as you approach that threshold apparently. I bet it has something to do with moods - like if you answer a quick survey/question about how you're feeling when you log in to Netflix that could affect your decisions. Maybe if you quantified moods like fill out a questionnaire when you sign up for the service and then that translates your "happy" to a 9 and then "annoyed" to a 3 and "depressed" to a 2. Then when you login you rate your feeling on a 1-10 scale that's translated to reflect your mood and that affects whether you're shown "Pursuit of Happyness," "Napoleon Dynamite" or "Scarface." I bet that's the answer. Just hand me 100k when you put that into something workable.

Anybody wanna start a team with me to solve the Netflix Challenge? You win $1 MILLION if you can improve their recommendation system by 10% - which gets increasingly harder as you approach that threshold apparently. I bet it has something to do with moods - like if you answer a quick survey/question about how you're feeling when you log in to Netflix that could affect your decisions. Maybe if you quantified moods like fill out a questionnaire when you sign up for the service and then that translates your "happy" to a 9 and then "annoyed" to a 3 and "depressed" to a 2. Then when you login you rate your feeling on a 1-10 scale that's translated to reflect your mood and that affects whether you're shown "Pursuit of Happyness," "Napoleon Dynamite" or "Scarface." I bet that's the answer. Just hand me 100k when you put that into something workable."I Can See" - Jazzanova feat. Ben Westbeech

Sunday, November 9, 2008

never been so deep into anyone else but you

Thursday, November 6, 2008

Obama's 11/4 Speech

There are not enough words in all of the languages in the word to describe it - the light of the people, the joy that has been gone for so long, a glimmer that maybe if we stand for something we won't fall for anything and a difference is possible. Renewal. Unity. LOVE. Regardless of who you support, who you voted for, why you voted.... it's time to rebuild, to truly unite. There's a freshness here for all of us that wasn't here before. I have people reporting back from as far away as Mozambique who are feeling the love as WORLD citizens. There are not enough words. I thank God.

Sunday, November 2, 2008

two more days

Monday, October 27, 2008

you can vote however you like

He showed this to me yesterday and, due to an unfortunate set of circumstances which led to a drained iPod battery, this has been stuck in my head all day. These kids are absolutely adorable and their energy has me so hyped I want to early vote again! Seriously though, if you haven' voted yet get out there soon. Early voting end 10/31 and why wait in that line next Tuesday if you don't have to?! You can vote however you liiiiike....

My bad on the blog slippage. I have a million and one fantastic things going on that keep me from sitting around blogging- which you probably know all of if you are following my Twitter - but I'll get back to some sort of regular update one day!

Thursday, October 9, 2008

by the time you're 30...

Today I'm obviously sifting through old emails while at work with some downtime. Another of my best girlfriends sent me a faaabulous poem by Maya Angelou entitled "A Woman Should Have." I googled it and found that it's not from Ms. Angelou but rather Pamela Redmond Satran from an article she published in Glamour in 1997. Here's the updated version:

By 30, you should have:

- One old boyfriend you can imagine going back to and one who reminds you of how far you’ve come.

- A decent piece of furniture not previously owned by anyone else in your family.

- Something perfect to wear if the employer or man of your dreams wants to see you in an hour.

- A purse, a suitcase and an umbrella you’re not ashamed to be seen carrying.

- A youth you’re content to move beyond.

- A past juicy enough that you’re looking forward to retelling it in your old age.

- The realization that you are actually going to have an old age—and some money set aside to help fund it.

- An e-mail address, a voice mailbox and a bank account—all of which nobody has access to but you.

- A résumé that is not even the slightest bit padded.

- One friend who always makes you laugh and one who lets you cry.

- A set of screwdrivers, a cordless drill and a black lace bra.

- Something ridiculously expensive that you bought for yourself, just because you deserve it.

- The belief that you deserve it.

- A skin-care regimen, an exercise routine and a plan for dealing with those few other facets of life that don’t get better after 30.

- A solid start on a satisfying career, a satisfying relationship and all those other facets of life that do get better.

By 30, you should know:

- How to fall in love without losing yourself.

- How you feel about having kids.

- How to quit a job, break up with a man and confront a friend without ruining the friendship.

- When to try harder and when to walk away.

- How to kiss in a way that communicates perfectly what you would and wouldn’t like to happen next.

- The names of: the secretary of state, your great-grandmother and the best tailor in town.

- How to live alone, even if you don’t like to.

- How to take control of your own birthday.

- That you can’t change the length of your calves, the width of your hips or the nature of your parents.

- That your childhood may not have been perfect, but it’s over.

- What you would and wouldn’t do for money or love.

- That nobody gets away with smoking, drinking, doing drugs or not flossing for very long.

- Who you can trust, who you can’t and why you shouldn’t take it personally.

- Not to apologize for something that isn’t your fault.

- Why they say life begins at 30.

did you know? 2.0

Did You Know? originally started out as a PowerPoint presentation for a faculty meeting in August 2006 at Arapahoe High School in Centennial, Colorado, United States. The presentation "went viral" on the Web in February 2007 and, as of June 2007, had been seen by at least 5 million online viewers. Today the old and new versions of the online presentation have been seen by at least 15 million people, not including the countless others who have seen it at conferences, workshops, training institutes, and other venues.

Wednesday, October 8, 2008

I must admit it helped a little bit...

Tuesday, October 7, 2008

can't keep my cool, so I keep it true

'Ye debuted the "Love Lockdown" video on Ellen today. I haven't seen it posted much yet but I think it's cool he premiered it on Ellen. The song has grown on me and I think the remixes will be endless on this one but its nothing that I'm just bumping all the time. The video concept is different and I think it reflects a growing movement to not just put big cars and big thangs in your video but put some thought into the development of your art as it is, take it or leave it. I'll take some more, thank you.

Monday, October 6, 2008

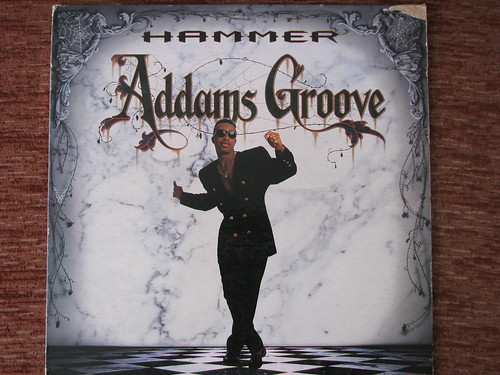

addams family groove

MC Hammer - Addams Family Groove

Kid S_i_s_t_e_r - Family Renion feat. David B_a_n_n_e_r

I just added RCRD LBL to my Google Reader and saw this:

From your 73 subscriptions, over the last 30 days you read 5,311 items, starred 129 items, shared 40 items, and emailed 0 items.

do I or don't I? equities edition

“Whatever money you may need for the next five years, please take it out of the stock market right now, this week. I do not believe that you should risk those assets in the stock market right now.”

While the animated Cramer is known for telling investors the best prospects for earning money on the stock market, he’s now saying retreat is the best position in the face of some of the worst financial news in decades. The bank lending default crisis that put financial firms around the country on the brink of collapse could bring “as much as a 20 percent decrease in the stock market,” Cramer predicted.

He called the U.S. government’s $700 billion bailout plan, which includes raising the insured rate on bank deposits from $100,000 to $250,000, as a “good one,” assuring bank depositors: “Your money is safe.”

But he warned that the same may not be true for stock market investors.

“I don’t care where stocks have been, I care where they’re going, and I don’t want people to get hurt in the market,” Cramer told Curry. “I’m worried about unemployment, I’m worried about purchases that you may need. I can’t have you at risk in the stock market.”

Still, those with the assets — and the stomach — to ride out the stock market’s ups and down over a five-year period might be best served by holding their nose and holding onto their stocks.

“I think what you have to do, if you can withstand it, is just ride it out,” Cramer said.

Very rarely does someone tell you to pull your money out of the stock market. It adds to volatility and the "I can just put it back in when the market turns around" theory doesn't usually take into account the transaction costs associated with hopping in and out the market. I talked to a classmate about possible action plans for people like us and people like our parents. For us it doesn't really matter, no one really knows if we're going into a recession or a depression and we can afford to experiment a bit with excess fundage - especially with no kids, no spouse, no mortgage, etc. Don't play more than you can afford to lose. However, for our parents it's much more complicated. 5 years to retirement? VERY tough call. Hopefully their retirement plan is diversified enough where the overall loss to the market is only affecting a smaller portion of the portfolio - when nearing retirement you don't want all of your funds in risky assets anyways. What if they do have too much money in equities? Is it time to pull out and take your L's? It's time to make an appointment with your financial planner. If your retirement is closer to a 10 year plan I think its safer to bet you should ride it out and avoid transaction costs, etc. But that's assuming the markets will rebound and I honestly feel like all bets are off in 2008. I was much younger during the last recession but I feel like, with the panic that we're seeing in the media, its safe to say this is unprecedented and we must tread carefully.

Last Friday the McCombs Business School hosted a Dean's Forum on the Financial Crisis. I only made it for the tail end because I still had class (again -- was it worth class to miss it? I was torn.). Luckily they taped the entire thing and posted it up HERE. This was a meeting of some of the most experienced, intelligent, and educated minds that McCombs has to offer and they offered incredibly vivid insight into the situation. This was a talk by business educators to budding business professionals. They referred to concepts we knew, they didn't sensationalize, and they countered hopeful statements with harsh realities. I was disappointed that more of my friends weren't in attendance, but luckily they've started coming to me asking me what exactly is going on and why they have to be worried anyway.

I know we're all busy and preoccupied with our own lives but do yourself a favor and go watch the video on the McCombs site. This is such a valuable opportunity: to get this discussion and decomposition of the situation geared towards intelligent young people, not the general public audience of the nightly news that hasn't been following as closely and just wants the hard and fast conclusion. This is a situation that doesn't lend itself well to a hard and fast conclusion.

Thursday, October 2, 2008

vp debate night!

Let's get ready to rumble people! What exciting news bites are we going to get out of tonight?

To get this party started right play a couple rounds of "Debate Night" - Obama's unofficial video game:

http://www.powerfulrobot.com/games/obama/

and if you got a group together go ahead and break out the Palin Bingo cards - I just printed mine out:

http://palinbingo.com/

In the meantime check Jay Smooth put the economic situation in perspective:

I had more to post but I'm all sleep deprived and I'm on my way out the door to my own movie night aka ya'll thought we were gonna watch a movie but I brought my laptop and we're watching live blogging of the debate -- suckas! http://election.twitter.com/

This has nothing to do with anything I just like the song:

Keane - "Spiralling"

Tuesday, September 30, 2008

janelle monae

http://www.myspace.com/janellemonae

http://www.jmonae.com/

You can bet this chick has your friendly neighborhood hipster buzzing. She's been generating her share of internet stans for a very hot minute (since '05?) but it seems she's finally getting the widespread hype that is seemingly inevitable once you hear her electric voice. I saw her recently on the cover of Paste Magazine and shes all over the internet these days. Who is Janelle Monáe? Wikipedia has her as an alternative, soul, futuristic, and rock performer and singer who dabbled in Broadway momentarily before breaking for the music scene. She's 23 and hails from KC, Kansas. She recently dropped a video for "Many Moons" but she's been around since the Got Purp? Vol. 2 days which I only know about because of him.

The video is absolute bonkers - which is why it has everyone looking like:

Her voice is incredibly rich, the beat is wild, she's clearly on that other business (Android auctions?), and the video is full of theatrics and social commentary - precisely my cup of tea. To top it all off her style is literally one of a kind and she's gorgeous. The video and concept is so intense and complex and beyond me that I've returned to it a shameful amount of times. I love when art does that - incites something so complicated and buried and confusing that you have to keep visiting it and reevaluating your analysis.

Her voice is incredibly rich, the beat is wild, she's clearly on that other business (Android auctions?), and the video is full of theatrics and social commentary - precisely my cup of tea. To top it all off her style is literally one of a kind and she's gorgeous. The video and concept is so intense and complex and beyond me that I've returned to it a shameful amount of times. I love when art does that - incites something so complicated and buried and confusing that you have to keep visiting it and reevaluating your analysis. From the chorus and 2nd verse:

(The silver bullet's in your hand and the war's heating up)

And when the truth goes BANG the shouts splatter out

(Revolutionize your lives and find a way out)

And when you're growing down instead of growing up

(You gotta ooo ah ah like a panther)

Tell me are you bold enough to reach for love?

So strong for so long

All i wanna do is sing my simple song

Square or round, rich or poor

At the end of day and night all we want is more

I keep my feet on solid ground and use my wings when storms come around

I keep my feet on solid ground for freedom

You're free but in your mind, your freedom's in a bind

I'm all about doing you, no matter what the crowd thinks is legit or normal. Her other stuff gets a little...weird?...at times but its entertaining to say the least and often the result is fabulous. I first heard Janelle on the song "Call the Law" from Idlewild (you remember that movie, don't you?). She was striking and classic and it was the only song on the soundtrack that made a permanent playlist (*singing* "just grab my gun and let's go out...") - which is the standard against which all good music related to moi is measured:

vote for twitter

how nervous are we?

Notice how it has shot up in the past few days relative to the rest of the year. If I had more time I would put in markers through the year so we could get a feel for how the market has responded to earlier events. But I don't, so I won't.

Now compare that to VIX over the past 10 years:

You can see that the last time the VIX index was as high as it is now (although it's down 12% today as of 11 AM as markets rebound a bit) was during the tech bust of the late 90's and the subsequent recession of 2000-2001. In an economy that seems to be driven by fickle investors who may or (most likely) may not have all relevant information (just see what happened with United)

3. Intrade Prediction Markets - Intrade is often cited for its political prediction markets which you'll see as soon as you click on the site but it's basically a place you can go to speculate on real events.

"We've created an exchange for you to trade (speculate on) events that directly affect your life, like politics, entertainment, financial indicators, weather, current events and legal affairs - these are our trading categories. Within each category we list a set of contracts, a contract is an event that will have an unambiguous result. For example, some of our political contracts are: "Will George Bush be re-elected in 2004" or "Will John Kerry win the Democratic Nomination". Each one is an event with an unambiguous result, either George Bush will be re-elected or he won't." - from intrade.comBelow is the history of "US Recession in 2008." US Recession in 2009 looks similar. You can see how the price of a "share" has an overall decreasing trend although just the tail end of it shows a small reversal. Intrade is by no means always right or reliable but it's another piece of information to put in your toolbox.

I'm torn on the bailout and luckily I'm not one of the people who have to make a decision on it. This is one of those things where we won't get a true sense of how bad it is until we're out of it and looking at it in 20/20. The prof did mention that it might be a good time to get in the markets while everything is low - buy low sell high, right? - but that's assuming we're not on the verge of a complete collapse.

Thursday, September 25, 2008

did I stutter?

As far as the progression of the bailout plans go - by those who actually have a say in the matter - I'm torn. We definitely need a reorganization in the financial markets to help prevent this greed from pervading the economy again - to the detriment of those who are largely innocent in all related matters (you Responsible Americans "who pay your mortgage on time, file your tax returns on April 15 and are reluctant to pay the excess costs on Wall Street." (c) W. Bush). I don't have a problem with the "golden parachute" of top executives being punctured or complicated derivatives being subject to more regulation. But how much regulation? How much big government? How much will this cost?

These are questions that are largely going unanswered. The proposal for the funds by the Treasury was 3 pages long. This from a sector of the government notorious for extensive, verbose documents that hide the true meaning somewhere between the lines. Originally the proposal stated that the actions taken by Treasury Secretary Henry M. Paulson would not be subject to law, or rather "may not be review by any court of law or and administrative agency." Excuse me? We got into this mess by taking accountability out of the equation...so we're going to take accountability out on the other side? I don't see how the answer would be to pass a "blank check" on over to Paulson to do what he will with an estimated $700 billion. I haven't seen any calculations on how that figure was calculated and I've seen it fluctuate between $500 billion and $800 billion. Let us remember this is a government estimate and I'm willing to bet that, without some sort of accountability put into this process, that figure would increase quickly.

Bush declared last night in his prime time address (which I admittedly missed due to work): By investing taxpayer money in assets with underlying value, even if the market isn't yet sure what that value is currently, the government may make "much, if not all" of the money back when it resells the assets after the markets return to normal, Bush said.

Is it just me or does that not sound like a good business deal? Nobody, least of all George W., has dealt with this situation before, especially with these securities. "We're not sure, but you'll probably get most of your money back eventually" would get me an "F" real quick in my financial analysis courses. I understand something needs to happen but the pressure and speed with which Paulson, Bernanke, and Bush are pushing for this legislation all seems a little sketch to me. It reminds me of a clip from the Office where Dwight tells Michael he has an emergency back up plan to restore order to the office: he holds all the power. He pushes and pushes on Michael to delegate all power to him. Earlier in the episode the thought blocking that Dwight utilized by repeatedly urging agreement worked on Andy when Dwight was able to get a car from him for a super low price and then flip it immediately. Hilarity ensues. Dwight promises to relinquish power once the crisis has been resolved but Michael ultimately prevails (surprisingly). Am I alone in seeing some parallels?

The following is a list of techniques of undue influence - thought reform - from cultclinic.org (not one of my sites but I found it through following this article):

- GROUP PRESSURE and "LOVE BOMBING" discourages doubts and reinforces the need to belong through the use of child - like games, singing, hugging, touching, or flattery.

- ISOLATION\SEPARATION creates inability or lack of desire to verify information provided by the group with reality.

- THOUGHT-STOPPING TECHNIQUES introduce recruit to meditating, chanting, and repetitious activities which, when used excessively, induce a state of high suggestibility and dependency on the group.

- FEAR and GUILT induced by eliciting confessions to produce intimacy and to reveal fears and secrets, to create emotional vulnerability by overt and covert threats, as well as alternation of punishment and reward.

- SLEEP DEPRIVATION encouraged under the guise of spiritual exercises, necessary training, or urgent projects.

- INADEQUATE NUTRITION sometimes disguised as special diet to improve health or advance spirituality, or as rituals requiring fasting.

- SENSORY OVERLOAD forces acceptance of complex new doctrine, goals, and definitions to replace old values by expecting recruit to assimilate masses of information quickly with little opportunity for critical examination.

Do we punish those executives who got paid ridiculously well and took on all this debt without putting it on their balance sheets? Do we punish those bankers who packaged up the debt and sold them, heralding the great returns? What about the bankers who issued all the subprime mortgages, often using shady promises and contracts to lock in people who could barely pay the introductory rate, much less the higher adjusted rate? What about those people who came in looking to buy a house beyond their means who weren't responsible enough to read the contracts and do enough financial planning to factor in their mortgage payments? It's easy to point the finger but how far to point? Will the bailout include a provision for judges to renegotiate mortgages so that a relatively large percentage of American's aren't pushed out on the street when they can't make their payments? Maybe some financial counseling would be involved? Would the bailout money go towards any of that or just towards buying up faulty debts from corporations' balance sheets (or rather off their balance sheets - and to that extent nobody knows the full extent of this crisis because everyone is playing close to the chest)?

In this fantastic piece by Timothy Egan entitled "Crash" he compares the current situation to that of the Great Depression and reiterates how we got to this point:

In this century, thanks to the deregulatory demons released by former McCain adviser Phil Gramm and embraced by just enough lobbyist-greased Democrats, Wall Street was greenlighted again to act like a casino. Banks in the heartland passed on their mortgages to Wall Street, where they were sliced and diced in hundreds of largely incomprehensible ways. And while few people understand how those investment giants made money, this much is clear: it was a killing. In 2006 alone, Wall Street firms paid out $62 billion in bonuses.

With all the urgency of that famous National Lampoon magazine cover that showed a cute pooch with a gun to its head, and the line “If You Don’t Buy This Magazine, We’ll Kill This Dog,” President Bush says the biggest bailout in American history must be passed now or the world will crumble. He said a similar thing in the run-up to war.

He also points out that the details of this bailout have yet to be nailed down:

“I’m a dirt farmer,” said Senator Jon Tester, the Montana Democrat who still lives on his family homestead. “Why do we have one week to determine that $700 billion has to be appropriated or this country’s financial system goes down the pipes?”

Good question, one that Treasury Secretary Henry M. Paulson and Federal Reserve Chairman Ben Bernanke have yet to adequately answer. If they seemed flummoxed, perhaps it’s because they still can’t explain what will be accomplished by nearly nationalizing the banking system and giving the treasury secretary more power than a king.

Clearly there are a lot of unanswered questions. It's an interesting moment in history, to say the least, to see all these factors rear their ugly head simultaneously and with such poignant timing. I, for one, would like to see the debate go on but maybe that's just me being anxious and, in the process, being insensitive to the economy.